Fintech (financial technology) is a cutthroat, complex, and increasingly competitive industry. With the need for increased speed to market to stay competitive, fintech product leaders need to run their product portfolio like a well-oiled machine. Operating in a highly regulated industry requires flexibility, adaptability, and frequent pivots due to external and regulatory changes. Layering on top of that is dependencies.

In this post, I’ll cover how to run an effective fintech product team at scale:

- Key factors that set fintech companies (fintechs) apart

- The key strategies for fintech success

- How to execute winning fintech strategies

What Sets Fintechs Apart?

To ensure success in this space, we must first address what sets fintechs apart from other industries.

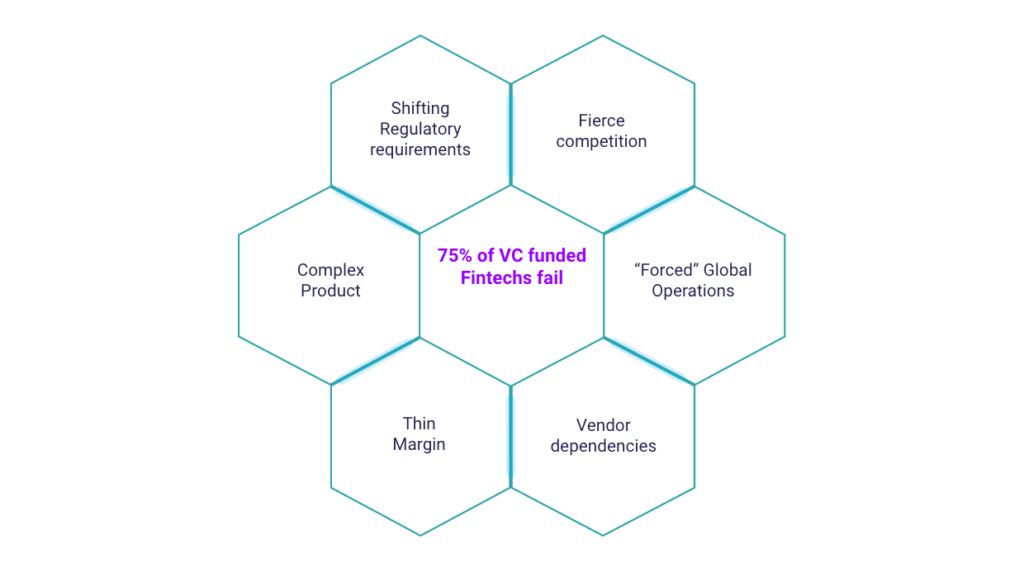

Where fintechs may be easy to start, they are hard to scale. There are a couple of reasons that make fintechs challenging to scale. Let’s take a look at some of the most common reasons:

- Fintechs sell complex products with different users, segments, and use cases.

- Global operations are typically “forced.”

- They constantly face shifting legal and regulatory requirements.

- Most require a strong dependency on third parties or external vendors for core capabilities.

- There is fierce competition from existing traditional financial institutions and incumbents.

- Unless you are doing lending, fintech is a very thin margin business.

Because the fintech industry is complex by nature, companies either need massive capital investments or execute practices to thrive in the environment to survive. In the absence of the former, a few key strategies will pave the way for fintech success.

Key Strategies for Fintech Product Portfolio Management Success

Now that we understand the unique traits of the fintech industry, we can get into setting your team and company up for success. Let’s break down the process:

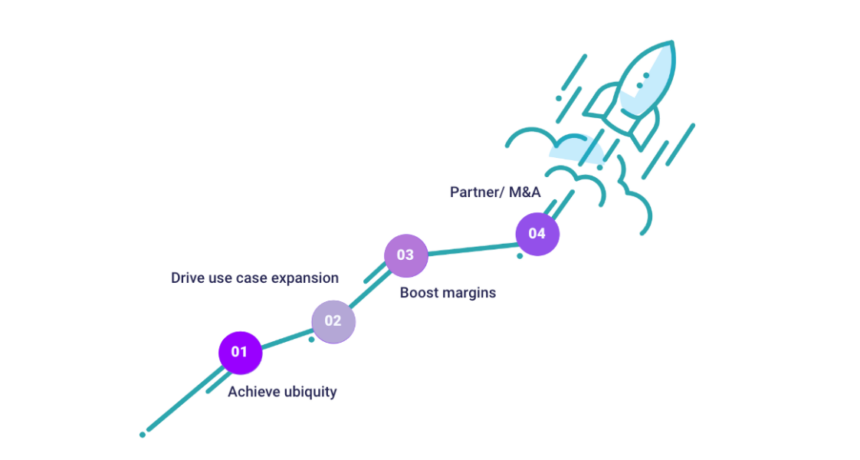

- Reach ubiquity as fast as you can

- Drive use-case expansion

- Boost margins

- Partner with mergers and acquisitions (M&A)

1. Reach Ubiquity As Fast As You Can

To achieve ubiquity, fintech companies must ship smart and fast with a single product early on.

One of the best examples of this comes from the $60 billion company, Block Inc. (formerly Square Inc.).

In its conception, Block started small before it had several digital service products. The team began with a card reader dongle that consumers could use with their phones, allowing them to accept payments anywhere. This initial focus on one product allowed Block to stay top-of-mind for its target customer, small merchants, and it opened the door for expanded adoption.

2. Drive Use-Case Expansion

Use-case expansion is about allocating new products as soon as there is the first sign of product-market fit.

“Ubiquity and use case expansion really have to come together immediately one after another. Fintech is a cutthroat industry, so your next focus is how can our company improve adoption? That’s why use-case expansion is the immediate focus after ubiquity.”

Becky Flint, CEO and Founder of Dragonboat

In PayPal’s early days as a part of eBay, its strategy was simply to “thrive on eBay.” The PayPal team wanted to capture as much market share and volume as possible. However, there was a flaw in remaining in the ubiquity phase, resulting in missed growth.

PayPal noticed that there was a gap in eBay’s market and that a lot of merchants were not selling on eBay. That’s when PayPal transitioned into driving use-case expansion and set out to target those people. That is when the real growth began.

In 2006, eBay was more than 75% of PayPal’s revenue, and by 2015, it made up only 15%. Ultimately eBay and PayPal split, and PayPal went on to be a $90 billion company.

If you continuously focus on improving your existing product, you will overlook significant new business opportunities, ultimately diminishing returns and hamper continued growth.

3. Boost Margins

To stay competitive in fintech, companies need to boost their margins. However, fintech is a thin-margin business, so how can you increase margins as a way to scale?

“With no infinite amount of funding, boosting margins is no easy task. This is what makes fintech product managers so unique because in order to be successful, they must be business savvy.”

Becky Flint, CEO and Founder of Dragonboat

Fintechs operate in a fast-moving market, so to boost margins at a scaling fintech, you have to look at the market and the changing landscape. Let’s check out what PayPal did back in the day.

At the time, when you used a credit card globally, there would be a foreign exchange fee somewhere around 3%, which was cutting the margin.

PayPal saw this as an opportunity. As a global company, it already had multiple currencies, so PayPal sought to do an internal exchange. That way, instead of letting a credit card company handle foreign exchange fees at 3%, consumers could have PayPal take it for only 2%—a win-win for everyone.

4. Partner with Mergers and Acquisitions (M&A)

Lastly, most successful scaling fintech companies eventually partner with mergers and acquisitions to fully mature their business.

2021 was the most active year for fintech M&A, and 2022 is tracking to yield similar results.

There are a few reasons fintech companies partner with M&A. Most importantly, it allows them to diversify the products they offer, get ahead of the competition, and succeed in a global market.

For example, Block acquired the Australian Buy Now, Pay Later (BNPL) firm Afterpay in Australia’s biggest ever buyout to capitalize on the boom in the Buy Now, Pay Later space and remain competitive. Jack Dorsey, co-founder and CEO of Block, remarked, “Together, we can better connect our Cash App and Seller ecosystems to deliver even more compelling products and services for merchants and consumers, putting the power back in their hands.”

Another example of an M&A to stay competitive and innovative is Paypal’s move to acquire cloud-based infrastructure Curv for digital asset security, expanding its initiatives to support cryptocurrencies and digital assets.

How Can You Execute Winning Fintech Strategies?

So now that we have covered “the what,” let’s get into “the how.” A winning fintech strategy requires a responsive portfolio workflow.

As fintech goes through various phases of evolution, from ubiquity to use-case, product leaders need to be able to adjust quickly. A portfolio workflow gives you the ability to see your roadmap. This is key for product companies that are complex and scaling to catch potential problems early.

A responsive portfolio workflow is unique for its three-directional movement:

- Top-down alignment – Provides the overall direction of where the company wants to go to help focus on the additional ways to grow.

- Bottom-up empowerment – Brings the product to more markets. With the overall direction paved, bottom-up empowerment provides new ideas and concepts to take the company to the next level.

- Cross-team collaboration – An effective, responsive portfolio workflow requires multiple teams to come together to execute bottom-up empowerment and reach the vision and direction established by top-down alignment.

Implementing a Responsive Fintech Product Portfolio Workflow

With a responsive portfolio workflow (and the right outcome-focused platform), fintech teams can achieve business goals, manage multiple teams, and scale. Let’s look at an overview of how you can implement an outcome-driven product management workflow.

Step 1: Define Objectives

The first step is to make sure you can see what to focus on and how various teams will support your many goals. Fintech is complex, and so you need to be able to see the dependencies across all levels of your organization.

After defining goals and strategies, you need to consider how to support them.

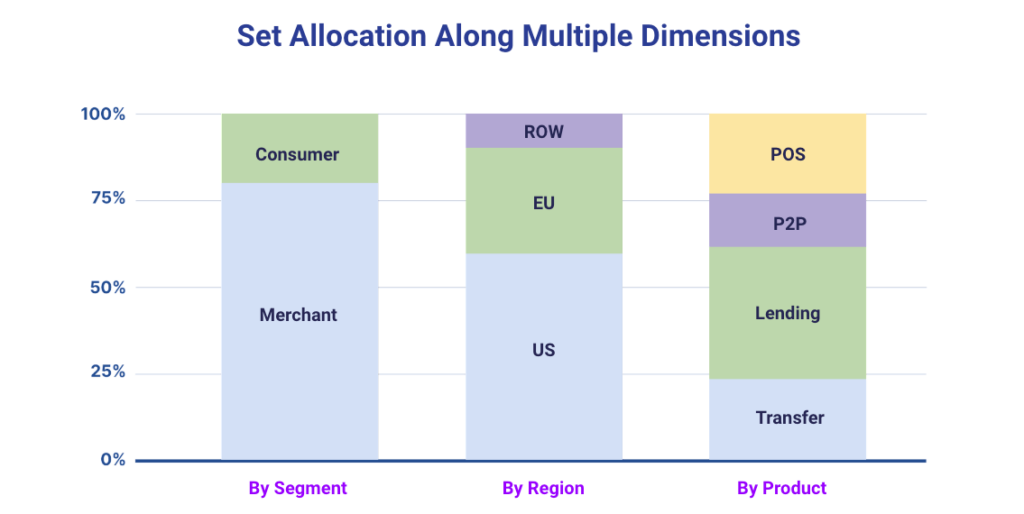

Step 2: Set Allocation/Estimates Along Multiple Dimensions

Strategy without resource allocation is a pipedream.

Think about your allocation in three dimensions:

- Segment

- Region

- Product

The ability for your fintech to scale is directly correlated to your ability to see your portfolio in different dimensions and allocate resources against the strategy. That is the key differentiator between successful and unsuccessful.

Step 3: Connect Goals, Strategies, and Execution

In fintech, there are multiple levels of dependencies, and they require various teams to support initiatives. Connecting goals, strategy, and execution is vital to avoid misalignment and chaos.

This is one area a tool can visualize how everything ties together, from your feature goals to your team contributions. This alignment will push your organization forward by making product roadmap planning, resourcing, progress tracking, and communication much more effortless.

Step 4: Prioritize Across Teams

When you start thinking about product strategy going from ubiquity to use case, your efforts need to connect allocation across all dimensions and tie that to your product and prioritization process. This shift in mentality helps companies evolve to where they want to be.

When looking to visualize how your allocation ties to goals, it doesn’t have to be 100% accurate. The idea is that you can quickly understand if you are performing well (i.e., over or under-allocating).

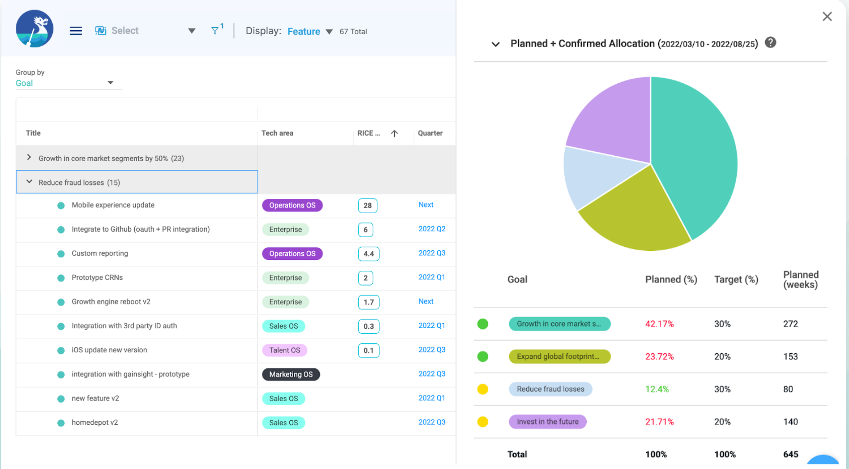

Pictured: Dragonboat demonstrating how strategies line up and how your work contributes to your goals and how you allocate to the previous target.

Step 5: Ensure Delivery

Once everything is set in its dimensions, you must be sure you are moving the needle.

Product and delivery in fintech are complex. The ability to see the roadmap and metrics tied to it will help a company see the problems and the changes.

Portfolio tools will allow you to see real-time updates and check in with the progress of your product. From there, you can use responsive reallocation to make any needed adjustments.

Step 6: Responsive Re/allocation

Responsive allocation is looking at your product and the road bumps it is facing and making adjustments to it to point your product in the right direction.

That is why having the ability to see your roadmap and the items tied to it is so vital for a complex, scaling company. Especially in fintech, many phases of evolution make a responsive workflow and outcome-focus planning key to success.

Manage Your Fintech Product Suite Like a Financial Portfolio

A portfolio-based approach will allow you to focus on core business and strategy to find winning products. You can use proven success and earlier success to adjust and reallocate.

In summary, winning portfolio workflows require fintech companies to be responsive, top-down, bottom-up, and across teams and adaptable depending on where you are in your business. The portfolio process starts by aligning on goals and strategy. This framework allows your company to manifest great products from different initiatives led by various teams.